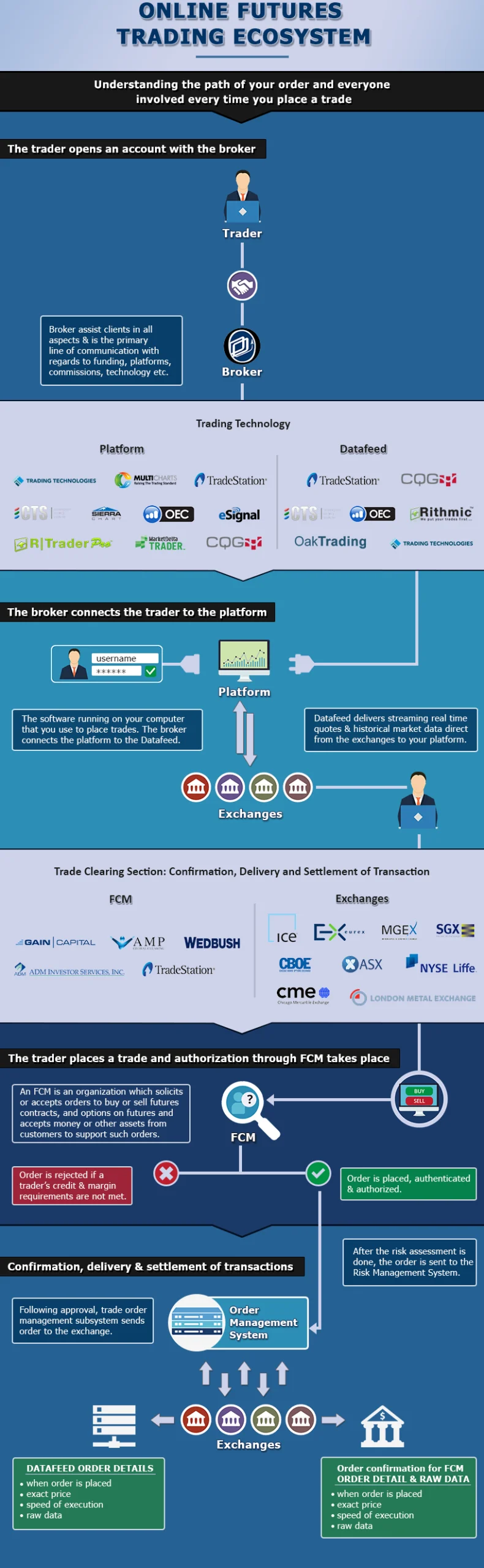

Once you have opened your futures account and are reviewing your options, one crucial decision is selecting the appropriate data feed and routing on your trading platform. Understanding the significance of this choice is paramount.

A data feed refers to the raw market data that flows directly into your computer from the data provider. It is akin to a digital ticker tape feed, displaying real-time price information for different commodities as their prices fluctuate. Even a slight time delay in this data can have serious consequences.

In practical terms, delayed data can be considered inaccurate, particularly for time-sensitive trades. A delay in data can give certain traders a timing advantage, while rendering time-based decisions ineffective. Successful trading relies on having relevant and timely data readily available for the most competitive traders.

Now, let’s consider the routing network required to transmit your trade order. For serious traders, a swift and efficient routing pipeline is essential. When you place an order on your trading screen, it triggers a series of events. The order is transferred from a physical location to be forwarded and flagged for risk management before reaching a trade desk, such as the Chicago Mercantile Board of Exchange.

Here, timeliness becomes crucial when the order reaches the Chicago desk. Even the slightest delay can put a trader at a disadvantage, particularly for day traders. Delayed trades can result in significant losses in terms of missed opportunities or capital, as other traders may have executed similar trades ahead of them. This is where the phrase “a day late and a dollar short” applies.

Hence, the importance of a fast order routing pipeline becomes evident. Being the last trader in line for an order fill is undesirable for competitive day traders, as speed is everything in their line of work. Regardless of having the best trading setups and skills, without the proper tools to execute them swiftly, their effectiveness diminishes.

Now, let’s explore how data feeds and order routing connect to your trading platform.

In general, there are two types of platforms:

- Platforms with their own integrated data feed, such as R | Trader Pro, Firetip, TT® Platform, and CTS T4.

- Platforms that connect to data feeds from third-party sources, like Sierra Chart and MultiCharts, which can link to multiple data feeds such as Rithmic and CQG.

Some platforms allow users to choose their data feeds based on specific qualities they seek, such as longer history, unfiltered data, full-level depth of market (DOM), and other technical features that experienced traders may require.

Bringing it All Together: A Practical Example of Futures Trading #

Let’s delve into the practical aspects of futures trading and examine a hypothetical trader named John, building upon our previous example. John has a bullish view on the broader stock market and wants to capitalize on its movements by going long on ES (S&P 500 futures).

To begin his trading journey, John opens a trading account with his preferred broker and carefully selects a trading platform that suits his trading style, which involves infrequent but high-volume trades. By accessing the centralized matching engine of the CME Group and choosing a suitable high-volume trading platform, John can execute trades on larger positions. For instance, he might average around 100 contracts per trade, while minimizing slippage. Here’s how he achieves this:

Faster Data Feed: #

John benefits from a swift data feed that provides real-time market action, enabling him to respond to market data with minimal delay. This allows him to make well-informed trading decisions based on the most up-to-date information.

Fast and Intuitive Platform: #

John relies on a fast and intuitive trading platform that facilitates seamless trade execution. With a user-friendly interface and efficient order placement tools, he can execute his trades swiftly and without inconvenience.

Fast Order Routing: #

Leveraging fast order routing, John’s trades are placed near the front of the order line, surpassing other orders that are routed at a slower pace. This grants him a competitive advantage in terms of order execution speed.

By combining these three elements—fast data feed, intuitive platform, and swift order routing—John optimizes his trading performance. This enables him to effectively navigate the futures trading landscape and capitalize on market opportunities.

To gain a better understanding of the futures trading landscape, take a look at the infographic we have created, which provides a visual overview of the key aspects involved in futures trading.