Securing funding is a fairly straightforward process, especially when collaborating with experienced traders. Only a small fraction, less than 10%, of traders attempting to secure funding succeed, which is why instances of traders acquiring funding are not as widely publicized. Numerous variables can impact the likelihood of a trader successfully obtaining funding, and the skill of balancing these factors often determines a trader’s success or failure.

Upon initial enrollment for a funded account, traders enter an ‘Evaluation Period’. During this phase, they are provided with a paper/simulated trading account to demonstrate their skills before gaining access to actual capital for trading.

Within the evaluation period, traders must achieve specific targets to qualify for funding. These benchmarks encompass:

- Number of Tradable Contracts

- Minimum Days of Trading (Always 7)

- Minimum Profit Attained

- Trailing Drawdown Threshold Not Exceeded

These criteria can vary depending on the account value, except for the minimum trading days requirement. For instance, a $25,000 account might necessitate a Minimum Profit of $1,500, a Trailing Drawdown of $1,500, and a total of 4 Tradable Contracts. Conversely, a $50,000 account might mandate a Minimum Profit of $3,000, a Trailing Drawdown of $2,500, and a total of 10 Tradable Contracts, and so on.

After successfully fulfilling the minimum requirements during the evaluation period, traders can submit their accounts for approval from Apex Trader Funding. Once the firm confirms that the requirements have been met, the account transitions from the ‘Evaluation Period’ to a ‘Paid/Funded Account’.

At this juncture, any profits generated within the account become the trader’s earnings. The initial $25,000 profit is entirely retained by the trader, while subsequent profits are subject to a 90/10 split between the trader and the firm. The trader receives 90% of the profit, and the firm receives 10%.

It’s important to note that losses incurred within a live account do not necessitate repayment. Nevertheless, there are limitations on potential losses, underscoring the significance of maintaining appropriate risk management and tradable liquidity.

The Evaluation Period #

When you initially obtain a funded account you are usually put through a 1 or 2 phase evaluation period, where you will be required to pass and comply with certain parameters in order to make it to the next phase or receive the actual funded account.

That means that the first account you trade on, will be what’s considered an ‘Evaluation’ account which in all technicality is just a paper trade account, except the prop firm which issued your account to you is able to monitor your performance.

Our preferred firm, Apex, is a 1 phase firm with only 3 rules and easy to obtain performance metrics which include:

- Minimum Profit Target (How much you have to make to pass)

- Minimum Days Traded (How many days you have to trade to pass)

- Trailing Threshold Limit (The most amount of money you can lose before failing)

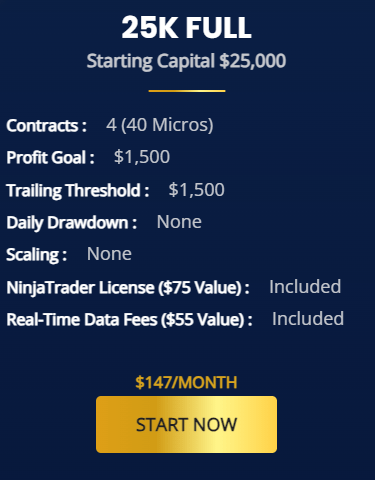

The numbers for each rule (aside from minimum days traded) depend on the account size in which you choose, but for the sake of simplicity, we will go over the $25k account. Below is a picture showing the specific amounts which we will go over below.

As you can see for the $25K account, you can only trade a max number of 4 contracts (when Mimic.Trading this number will never be surpassed), must reach a profit goal of $1500, and have a trailing threshold of $1500. This means that in order to pass and receive a full funded account you must not have:

- traded more than 4x contracts at once

- have made at least $1500

- and not hit the $1500 trailing threshold in a minimum of 7 days.

Trailing Drawdown/Threshold #

Prop firms use trailing drawdowns to measure the consistency of a trader by making sure they don’t give too much back to the market after making it.

At this point you may have wondered, what exactly is a trailing threshold? What is it trailing?

In the simplest explanation, a trailing THRESHOLD is a drawdown (the amount of money you can lose) that moves (trails) dollar for dollar with your accounts highest balance. This means that for every dollar you TRADE in PROFIT, you will LOSE the same amount of AVAILABLE THRESHOLD. This ultimately means that by the time you reach your profit goal, your trailing threshold is effectively $0, and you can’t lose anything below the accounts current balance.

So if you have a TRAILING THRESHOLD of $1500, and a STARTING BALANCE of $25000, that for each dollar the $25000 increases, the AVAILABLE THRESHOLD decreases, leaving you with less to potentially lose.

See the following as an example:

- Your starting balance is $25,000. Your threshold will be $23,500 ($1,500 below $25,000).

- You make $500 and close the trade. Your balance will be $25,500 and your threshold will be $24,000 ($1,500 below $25,500).

- Next, you enter a trade and get up to $26,000, but don’t close the trade until your balance is at $25,800. Then, your threshold will be $24,500 ($1,500 behind the highest live value of $26,000).

Now, in a Funded account the trailing threshold stops moving once your profit surpasses your trailing threshold by $100, meaning on a $25k account, once it reaches $26,600 ($25,000 balance + $1500 threshold + $100), the trailing threshold stops at $26,600 and won’t trail up with profits any further, allowing you to build your own cushion.

So, as you can see, the drawdown threshold liquidation is not based on when you close the trade but is based on the highest balance of when you are in a trade.

Being Funded #

Being funded has the same rules as the evaluation with a few minor variations. The main being how the trailing drawdown works, which we just discussed. Other than that it comes down to with how and when you can start paying your profits out, which we will go over in it’s own sections linked here.